Apple’s Siri is a smart virtual assistant that makes our iPhone and iPad even smarter. With the help of Siri, we can make calls, send messages, set reminders, and search for information. However, many users are unaware that they can change Siri’s voice. The option to change Siri’s voice on iPhone gives users a personalized experience. In this article, we will provide a detailed explanation of how to change Siri’s voice on iPhone, including the available options and key settings to consider.

Why do we need to change Siri’s voice?

Siri is not just a digital assistant, but it also provides a personalized interaction experience. Many times users want Siri’s voice to be according to their choice, such as:

Change voice tone (male or female voice)

Change accent – American, British, Indian, etc.

Improve language clarity

Customize user experience

For all these reasons, users like to change Siri’s voice.

How to Change Siri Voice on iPhone – Step-by-Step Guide

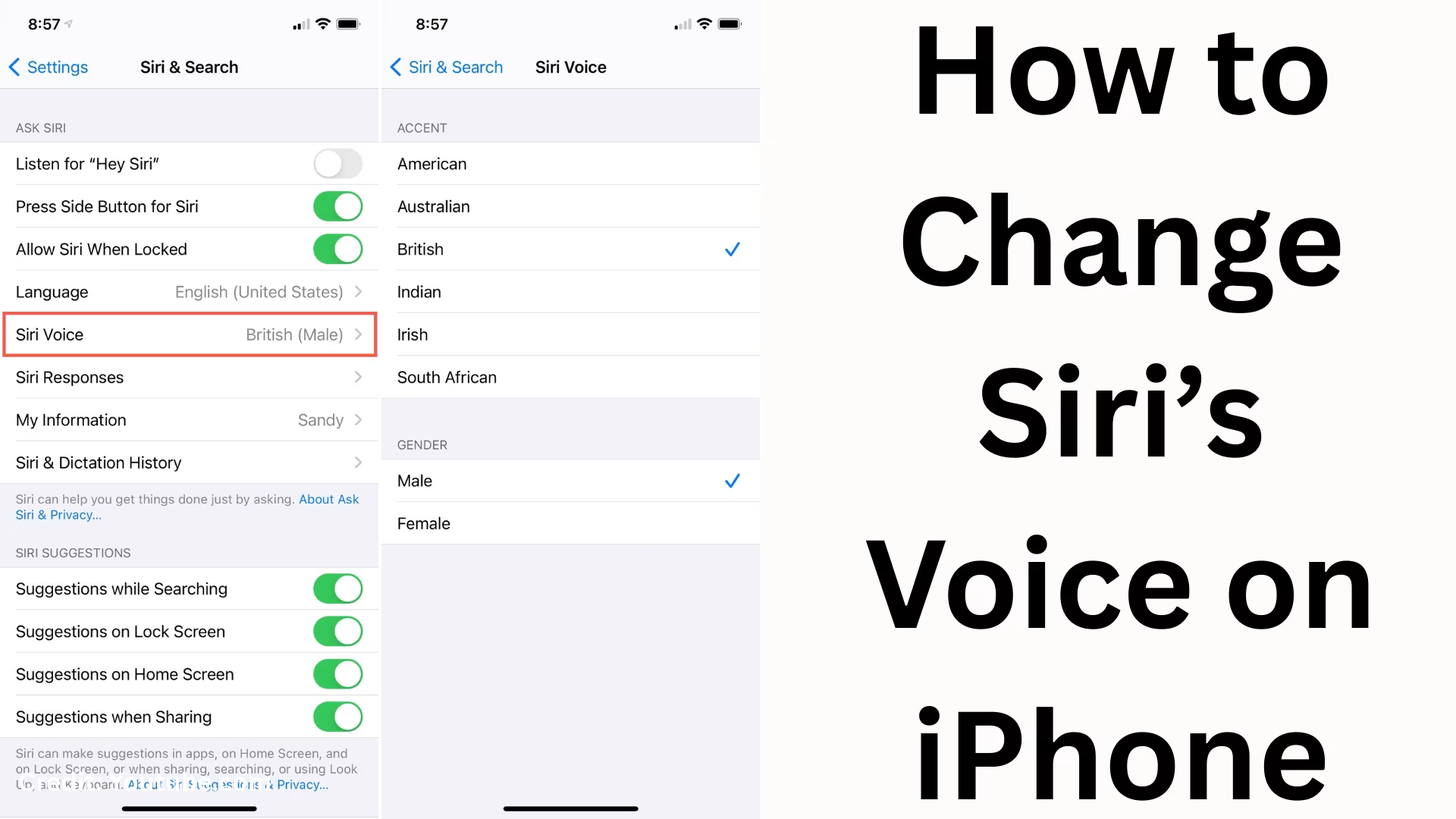

1. Open Settings

First of all, open the Settings app on your iPhone.

2. Select Siri & Search

Scroll down in Settings and tap on Siri & Search option.

3. Go to Siri Voice

Now you will find an option named Siri Voice here. Select it.

4. Select Voice Options

Now you will see many voice options. These include:

Voice 1, Voice 2, Voice 3, Voice 4 (male and female voices)

Different accents (American, British, Australian, Indian, etc.)

5. Choose your favorite voice

Now you can choose the Siri voice as per your choice.

6. Wait for the voice to download

If you have chosen a new accent or voice, Siri will download that voice. This may take a few minutes, depending on the internet speed.

Languages and accents available to change Siri’s voice

Apple has made Siri available in many languages and accents. When using Siri on an iPhone, you can select these languages:

English (United States, India, United Kingdom, Australia, Canada)

Hindi (India)

Spanish, French, German, Italian, Japanese, etc.

Each language has different voice tones and accents.

Things to keep in mind while changing Siri’s voice

An internet connection is required to change Siri’s voice.

Downloading the new voice may take time.

If your iPhone has less storage, there may be a problem with the download.

Siri’s voice change will only apply to the device on which you are setting up.

What are the benefits of changing Siri’s voice?

1. Personal experience – You can use Siri in your favorite voice.

2. Linguistic ease – If you want an Indian accent, you can easily change it.

3. Clarity and understanding – It will be easy to understand Siri according to your accent.

4. Enjoyment of device use – Siri can be made even more friendly by changing the voice.

Conclusion

Changing Siri’s voice on iPhone is a simple but very useful feature. With this, you can customize Siri according to your needs and get a better experience. Whether you want to change the accent or give Siri a male/female voice, Apple provides you with this feature.

Want to grow your website organically? Contact us now

Frequently asked questions about changing Siri’s voice

Question 1: Can I change Siri’s voice on iPhone?

Yes, you can change Siri’s voice to your liking on iPhone.

Question 2: What settings do I need to open to change Siri’s voice?

You need to go to iPhone’s Settings → Siri & Search → Siri Voice to change the voice.

Question 3: Is Siri available in Hindi?

Yes, Siri is available in Hindi, and you can set it to Hindi.

Question 4: Do I need the Internet to change Siri’s voice?

Yes, you need an Internet connection to download new voices or accents.

Question 5: Will changing Siri’s voice change on all Apple devices?

No, Siri’s voice will change only on the iPhone or iPad you set it to.

Question 6: What accents are available in Siri?

Siri has many accents available, like American, British, Indian, Australian, Canadian, etc.

Question 7: Does changing Siri’s voice change its speed or volume?

No, changing Siri’s voice only changes the tone and accent; the speed and volume remain the same.

Question 8: Will a new Siri voice be downloaded if my iPhone is low on storage?

No, downloading new voices may be difficult if I am low on storage.